Does Congress have the heart to avert disability crisis?

The least-known Social Security program will run out of funds in three years, possibly affecting 11 million Americans. Washington should stop wringing its hands.

http://www.latimes.com/business/la-fi-hiltzik-20130402,0,1163341.column

By Michael Hiltzik

April 2, 2013, 3:10 p.m.

Bonnie Lee worked for 12 years as a health technician for Kaiser Permanente in Southern California, started her own Web services company, and raised two kids as a single mother in Ontario.

Then Bonnie, 51, moved back East to rural Pennsylvania and took up work as a visiting nurse — until her leg shattered from an otherwise undiagnosed case of osteoporosis. Now she can't stand, drive or even sit up for long periods of time, much less lift a patient. In 2003, after a long wait during which she drained her IRA, life insurance and 401(k), she qualified for disability payments under Social Security.

"I've never been on the dole, never took welfare or food stamps," Bonnie, who asked to be identified by a pseudonym, told me this week. "I always made sure my kids had what they needed." Today, the $1,200 disability check she gets every month keeps her alive.

Her story is important because the program that keeps her fed and sheltered, Social Security disability, has a bull's-eye on its back — and not for the first time.

Quiz: Test your healthcare knowledge

Disability insurance, or DI, is the least-known and least-understood program within Social Security. It's also the worst-funded and facing an immediate crisis. You may have seen the forecast that Social Security's trust fund will be exhausted in the 2030s, at which point benefits would have to be cut or taxes raised. That's still a conjecture. But there's almost no doubt that the disability program's trust fund will run out in 2016, three years from now. At that point, absent congressional action, disability payments will have to be cut by about 20%.

"The insolvency of DI could not come at a worse time politically," says Kathy Ruffing, a budget expert at the Washington-based Center on Budget and Policy Priorities. This impending disaster could affect 8.8 million disabled Americans and their 2 million spouses and dependents. But a paralyzed Congress seems disinclined to even debate the necessary near-term fixes, which could include reallocating more of the Social Security payroll tax to the disability fund or raising the tax to shore up the program. Instead, Washington wrings its hands over the supposedly explosive growth of the program from 3 million beneficiaries in 1980. Expect to hear more about how disability is supposedly "out of control."

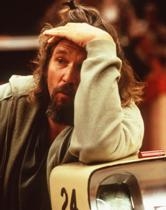

Perhaps because it covers a relatively small number of Social Security recipients, the disability program has always been a prime victim of mythmakers. Its beneficiaries are portrayed as slackers gaming the system like the Coen brothers' Jeff Lebowski, whiling away his life at the bowling alley and snarfing down White Russians. Last month the NPR program "This American Life" described the program as "a deal 14 million Americans have chosen for themselves," as though the typical recipient has chosen to suffer the debilitating medical conditions or mental syndromes that reduce him or her to subsistence on an average monthly check of $1,130.

The NPR report suggested that the caseloads of Social Security disability and its means-tested cousin, Supplemental Security Income, have "skyrocketed" because they've evolved into "hidden" substitutes for traditional welfare programs. In fact, as the social policy expert Harold Pollack has pointed out, the percentage of low-income children on SSI — they're its main beneficiaries — has remained fairly stable since the 1996 welfare reform. What's skyrocketed is the number of children in poverty in the United States — and the failure of all government relief programs to serve them adequately.

NPR was merely the latest in a long line of news sources to get disability wrong. Last year, New York Times columnist Nicholas Kristof claimed that rural families were pulling their children out of school so their illiteracy would keep them qualified for disability. He didn't actually identify anyone doing this, and in any case illiteracy and poor educational attainment aren't considered disabling conditions in and of themselves. The year before that, the Boston Globe reported that parents were placing their kids on hyperactivity drugs so they'd qualify for disability; government investigators found the opposite — kids on those medications were "more likely to be denied" benefits. In the 1990s, the media frenzy was over parents supposedly "coaching" their children to act crazy, which added the term "crazy checks" to the political lexicon. Again, no substantiation.

These are all varieties of a fictional genre known as "the undeserving poor" that encompasses Ronald Reagan's folksy yarns about welfare queens living on six-figure welfare handouts. The goal is to rationalize cuts in benefits by portraying their beneficiaries as morally depraved.

The picture of disability as an easy exit from the work line has never been accurate, but it's never far from the surface. Ruffing observes that antipathy to the program goes in cycles. After an expansion during the Carter administration, there was a big cutback in the 1980s under Reagan, which led in turn to a liberalization of standards in the 1990s, when state and federal officials recognized that too many people were being ejected from the rolls. Now the hostility is back, she says, "due to a very unfortunate confluence of events and facts."

The truth is that Social Security's disability standards are stringent. To be eligible you must have worked at least one-fourth of your adult life (typically from age 22 on), and been employed in at least five of the previous 10 years. Children qualify under Supplemental Security Income, and workers younger than 31 have to show employment in half the years since they turned 22.

You have to be too impaired to earn even $1,040 a month on your own. Just over a quarter of all applicants are approved initially, though an additional 13% or so win benefits on appeal. All in all, 41% of all applicants end up with checks. Sound easy to you?

As for the increased caseload, "the story is a fairly simple one of economics and demographics," Ruffing says. To begin with, the U.S. population is growing older: The ratio of those ages 50 to 64 increased by a third from 1980 to 2010, according to the Census Bureau, rising from less than 15% of the population to 20%. As Ruffing told a House subcommittee last month, people are twice as likely to become disabled at age 50 as at age 40, and twice again more likely at 60 as at 50.

Economic and workplace conditions have a big effect. It's easy to assert, as do some academic researchers, that disability rolls should be shrinking because work is no longer as toilsome as it used to be. When the Social Security disability program was created in 1956, assert David Autor of MIT and Mark Duggan of the University of Maryland, "a substantial fraction of jobs involved strenuous physical activity Yet the real-world workplace is still tougher than it looks from the faculty lounge. A 2010 study by the Center for Economic and Policy Research found that 45% of workers 58 and older held jobs that were physically demanding or involved difficult working conditions. Indeed, disability rates are closely tied to work conditions. In West Virginia, which has the nation's highest disability rate (12.5% of residents receive benefits), 150 out of every 1,000 jobs involve transportation, hauling, construction or mining. In California, which has the eighth-lowest rate (4.8%), those categories account for only 95 out of 1,000 jobs. The biggest factor may be the economy. With employment still running about 9 million jobs below where it would have been had pre-2008 trends continued, it's hardly surprising that disability rolls have grown. Disabled people always have more difficulty finding employment than others; when desk jobs disappear and all that's left are laborers' positions, the opportunities for the physically and mentally challenged only become more dire. "We all want to be taxpayers like everyone else," says Kira Fisher, 35, a program advocate for the North Carolina branch of the Arc, a disability advocacy group. Fisher, who suffers from cerebral palsy and also sustained injuries when a car hit her wheelchair last year, has been eligible for disability since 2002. She sees her $790 monthly checks as a bridge toward resuming work as a preschool educator or in full-time advocacy. "We don't want to be getting a check for the rest of our lives," she told me. Most of the solutions for the crisis in Social Security disability involve shifting its costs to employers, workers or state governments. These are all either not-gonna-happens or formulas for the impoverishment of the disabled. Caricaturing them as layabouts who should go get a job is just a cruel dodge. Forget all the persiflage about the debt ceiling and the deficit; this program is at a crucial point, and millions of lives are at stake. The moment of truth is here for Congress: Will it be heartless or humane? Michael Hiltzik's column appears Sundays and Wednesdays. Reach him at mhiltzik@latimes.com, read past columns at latimes.com/hiltzik, check out facebook.com/hiltzik and follow @latimeshiltzik on Twitter.

ที่มา: http://www.latimes.com/business/la-fi-hiltzik-20130402,0,1163341.column

วันที่โพสต์: 18/04/2556 เวลา 02:16:57

![]()

![]()

แสดงความคิดเห็น

รายละเอียดกระทู้

Social Security Disability Insurance beneficiaries are unfairly portrayed as slackers gaming the system like the Coen brothers\' Jeff Lebowski, whiling away his life at the bowling alley. (Merrick Morton / Grammercy Pictures) The least-known Social Security program will run out of funds in three years, possibly affecting 11 million Americans. Washington should stop wringing its hands. http://www.latimes.com/business/la-fi-hiltzik-20130402,0,1163341.column By Michael Hiltzik April 2, 2013, 3:10 p.m. Bonnie Lee worked for 12 years as a health technician for Kaiser Permanente in Southern California, started her own Web services company, and raised two kids as a single mother in Ontario. Then Bonnie, 51, moved back East to rural Pennsylvania and took up work as a visiting nurse — until her leg shattered from an otherwise undiagnosed case of osteoporosis. Now she can't stand, drive or even sit up for long periods of time, much less lift a patient. In 2003, after a long wait during which she drained her IRA, life insurance and 401(k), she qualified for disability payments under Social Security. "I've never been on the dole, never took welfare or food stamps," Bonnie, who asked to be identified by a pseudonym, told me this week. "I always made sure my kids had what they needed." Today, the $1,200 disability check she gets every month keeps her alive. Her story is important because the program that keeps her fed and sheltered, Social Security disability, has a bull's-eye on its back — and not for the first time. Quiz: Test your healthcare knowledge Disability insurance, or DI, is the least-known and least-understood program within Social Security. It's also the worst-funded and facing an immediate crisis. You may have seen the forecast that Social Security's trust fund will be exhausted in the 2030s, at which point benefits would have to be cut or taxes raised. That's still a conjecture. But there's almost no doubt that the disability program's trust fund will run out in 2016, three years from now. At that point, absent congressional action, disability payments will have to be cut by about 20%. "The insolvency of DI could not come at a worse time politically," says Kathy Ruffing, a budget expert at the Washington-based Center on Budget and Policy Priorities. This impending disaster could affect 8.8 million disabled Americans and their 2 million spouses and dependents. But a paralyzed Congress seems disinclined to even debate the necessary near-term fixes, which could include reallocating more of the Social Security payroll tax to the disability fund or raising the tax to shore up the program. Instead, Washington wrings its hands over the supposedly explosive growth of the program from 3 million beneficiaries in 1980. Expect to hear more about how disability is supposedly "out of control." Perhaps because it covers a relatively small number of Social Security recipients, the disability program has always been a prime victim of mythmakers. Its beneficiaries are portrayed as slackers gaming the system like the Coen brothers' Jeff Lebowski, whiling away his life at the bowling alley and snarfing down White Russians. Last month the NPR program "This American Life" described the program as "a deal 14 million Americans have chosen for themselves," as though the typical recipient has chosen to suffer the debilitating medical conditions or mental syndromes that reduce him or her to subsistence on an average monthly check of $1,130. The NPR report suggested that the caseloads of Social Security disability and its means-tested cousin, Supplemental Security Income, have "skyrocketed" because they've evolved into "hidden" substitutes for traditional welfare programs. In fact, as the social policy expert Harold Pollack has pointed out, the percentage of low-income children on SSI — they're its main beneficiaries — has remained fairly stable since the 1996 welfare reform. What's skyrocketed is the number of children in poverty in the United States — and the failure of all government relief programs to serve them adequately. NPR was merely the latest in a long line of news sources to get disability wrong. Last year, New York Times columnist Nicholas Kristof claimed that rural families were pulling their children out of school so their illiteracy would keep them qualified for disability. He didn't actually identify anyone doing this, and in any case illiteracy and poor educational attainment aren't considered disabling conditions in and of themselves. The year before that, the Boston Globe reported that parents were placing their kids on hyperactivity drugs so they'd qualify for disability; government investigators found the opposite — kids on those medications were "more likely to be denied" benefits. In the 1990s, the media frenzy was over parents supposedly "coaching" their children to act crazy, which added the term "crazy checks" to the political lexicon. Again, no substantiation. These are all varieties of a fictional genre known as "the undeserving poor" that encompasses Ronald Reagan's folksy yarns about welfare queens living on six-figure welfare handouts. The goal is to rationalize cuts in benefits by portraying their beneficiaries as morally depraved. The picture of disability as an easy exit from the work line has never been accurate, but it's never far from the surface. Ruffing observes that antipathy to the program goes in cycles. After an expansion during the Carter administration, there was a big cutback in the 1980s under Reagan, which led in turn to a liberalization of standards in the 1990s, when state and federal officials recognized that too many people were being ejected from the rolls. Now the hostility is back, she says, "due to a very unfortunate confluence of events and facts." The truth is that Social Security's disability standards are stringent. To be eligible you must have worked at least one-fourth of your adult life (typically from age 22 on), and been employed in at least five of the previous 10 years. Children qualify under Supplemental Security Income, and workers younger than 31 have to show employment in half the years since they turned 22. You have to be too impaired to earn even $1,040 a month on your own. Just over a quarter of all applicants are approved initially, though an additional 13% or so win benefits on appeal. All in all, 41% of all applicants end up with checks. Sound easy to you? As for the increased caseload, "the story is a fairly simple one of economics and demographics," Ruffing says. To begin with, the U.S. population is growing older: The ratio of those ages 50 to 64 increased by a third from 1980 to 2010, according to the Census Bureau, rising from less than 15% of the population to 20%. As Ruffing told a House subcommittee last month, people are twice as likely to become disabled at age 50 as at age 40, and twice again more likely at 60 as at 50. Economic and workplace conditions have a big effect. It's easy to assert, as do some academic researchers, that disability rolls should be shrinking because work is no longer as toilsome as it used to be. When the Social Security disability program was created in 1956, assert David Autor of MIT and Mark Duggan of the University of Maryland, "a substantial fraction of jobs involved strenuous physical activity assistive technologies were limited and crude." Yet the real-world workplace is still tougher than it looks from the faculty lounge. A 2010 study by the Center for Economic and Policy Research found that 45% of workers 58 and older held jobs that were physically demanding or involved difficult working conditions. Indeed, disability rates are closely tied to work conditions. In West Virginia, which has the nation's highest disability rate (12.5% of residents receive benefits), 150 out of every 1,000 jobs involve transportation, hauling, construction or mining. In California, which has the eighth-lowest rate (4.8%), those categories account for only 95 out of 1,000 jobs. The biggest factor may be the economy. With employment still running about 9 million jobs below where it would have been had pre-2008 trends continued, it's hardly surprising that disability rolls have grown. Disabled people always have more difficulty finding employment than others; when desk jobs disappear and all that's left are laborers' positions, the opportunities for the physically and mentally challenged only become more dire. "We all want to be taxpayers like everyone else," says Kira Fisher, 35, a program advocate for the North Carolina branch of the Arc, a disability advocacy group. Fisher, who suffers from cerebral palsy and also sustained injuries when a car hit her wheelchair last year, has been eligible for disability since 2002. She sees her $790 monthly checks as a bridge toward resuming work as a preschool educator or in full-time advocacy. "We don't want to be getting a check for the rest of our lives," she told me. Most of the solutions for the crisis in Social Security disability involve shifting its costs to employers, workers or state governments. These are all either not-gonna-happens or formulas for the impoverishment of the disabled. Caricaturing them as layabouts who should go get a job is just a cruel dodge. Forget all the persiflage about the debt ceiling and the deficit; this program is at a crucial point, and millions of lives are at stake. The moment of truth is here for Congress: Will it be heartless or humane? Michael Hiltzik's column appears Sundays and Wednesdays. Reach him at mhiltzik@latimes.com, read past columns at latimes.com/hiltzik, check out facebook.com/hiltzik and follow @latimeshiltzik on Twitter.

จัดฟอร์แม็ตข้อความและมัลติมีเดีย

รายละเอียดการใส่ ลิงค์ รูปภาพ วิดีโอ เพลง (Soundcloud)